The Technology Revolution in Value-Add Multifamily: How Smart Renovations Are Driving Returns in 2025

- Diego Guerra

- Oct 15, 2025

- 3 min read

Updated: Oct 22, 2025

By Diego Guerra

Updated October 15, 2025

The multifamily value-add landscape is experiencing a technological transformation that's reshaping how investors approach Class B and C renovations. As traditional renovation strategies face rising costs and labor shortages, smart technology integration is emerging as the key differentiator for maximizing returns while reducing operational overhead. This analysis explores how GCP and other forward-thinking investors are leveraging technology to create competitive advantages in today's challenging market environment.

The New Value-Add Playbook: Beyond Cosmetic Upgrades

Smart Home Integration: The New Standard

Today's renters, particularly millennials and Gen Z, expect technology-enabled living experiences. Our recent renovations have shown that properties incorporating smart home features command 8-12% rent premiums over traditional upgrades alone. Key technologies driving this premium include:

• Smart Thermostats: Reducing utility costs by 15-20% while providing tenant convenience

• Keyless Entry Systems: Eliminating lockout calls and improving security

• Smart Lighting: LED systems with app control that appeal to tech-savvy renters

• High-Speed Internet Infrastructure: Essential for remote work capabilities

Operational Technology: The Hidden Value Creator

While tenant-facing technology gets attention, operational technology is where the real value lies for investors:

Predictive Maintenance Systems: IoT sensors monitoring HVAC, plumbing, and electrical systems reduce emergency repairs by up to 30% and extend equipment life by 2-3 years.

Automated Leasing Platforms: Digital applications and virtual tours have reduced our leasing costs by 25% while improving prospect conversion rates.

Energy Management Systems: Real-time monitoring and automated controls have decreased utility expenses by 18% across our portfolio.

Market Dynamics Supporting Tech-Forward Value-Add

The Labor Shortage Solution

With construction and maintenance labor costs up 20-25% since 2022, technology offers a path to maintain margins while improving service quality. Automated systems reduce dependency on skilled labor for routine tasks, allowing teams to focus on higher-value activities.

Financing Advantages

Lenders increasingly favor properties with technology integration, viewing them as lower-risk investments with stronger cash flows. We've seen 15-25 basis point improvements in financing terms for tech-enabled properties versus traditional renovations.

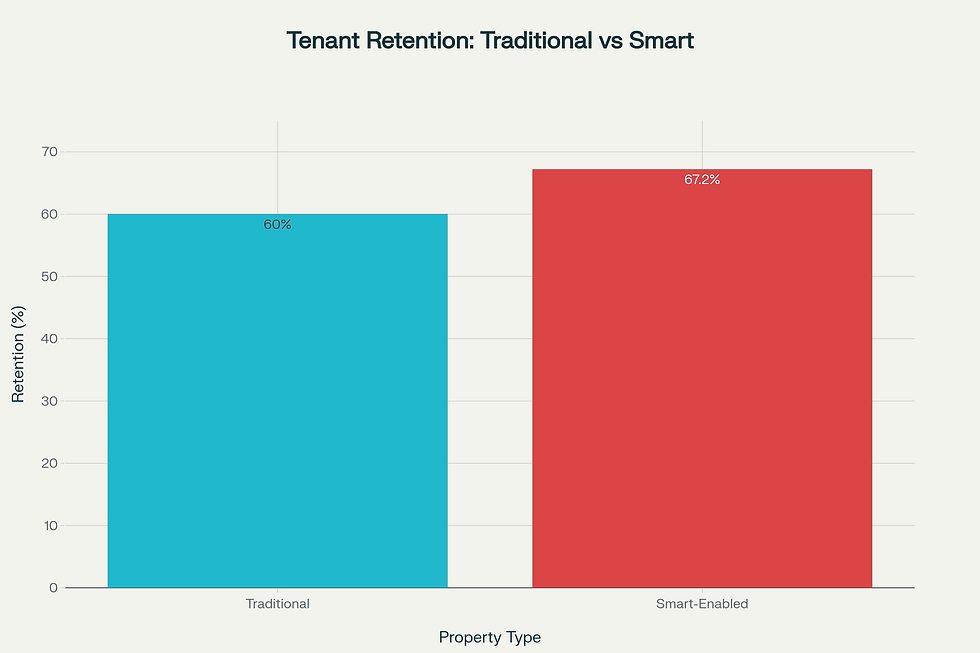

Tenant Retention Benefits

Properties with smart technology features show 12% higher renewal rates and 20% faster lease-up times. In today's competitive rental market, these metrics directly translate to improved NOI and asset values.

Implementation Strategy: Lessons from the Field

Phase 1: Infrastructure Foundation

High-speed internet backbone installation

Electrical system upgrades to support smart devices

Security system integration

Phase 2: Unit-Level Technology

Smart thermostats and lighting in all units

Keyless entry systems

Energy-efficient appliances with smart capabilities

Phase 3: Community Enhancement

Package lockers with smart notifications

Community Wi-Fi and co-working spaces

Mobile app for resident services

ROI Analysis: The Numbers Behind the Strategy

Our portfolio data shows that technology-integrated value-add projects deliver:

Average rent increases: 15-22% vs. 8-12% for traditional renovations

Reduced operating expenses: 12-18% through automation and efficiency

Faster stabilization: 6-9 months vs. 12-15 months for conventional projects

Higher exit cap rates: 25-50 basis points compression due to institutional appeal

Looking Forward: The Competitive Advantage

As the multifamily market continues to evolve, properties that fail to integrate technology will increasingly struggle to compete. The question isn't whether to incorporate smart technology into value-add strategies, but how quickly and effectively to implement these systems.

At GCP, we view technology integration not as an additional cost, but as a fundamental component of modern value-add investing. The properties we're renovating today are being positioned for the rental market of tomorrow, one where technology isn't a luxury, but an expectation.

Conclusion

The intersection of technology and traditional value-add strategies represents the next evolution in multifamily investing. As we continue to navigate elevated interest rates and construction costs, smart renovations offer a path to maintain attractive returns while building more resilient, future-ready assets.

For investors considering value-add opportunities in 2025, the message is clear: embrace technology integration as a core component of your renovation strategy, or risk being left behind in an increasingly competitive market.

Click below to explore real estate investment opportunities with GCP!

Comments